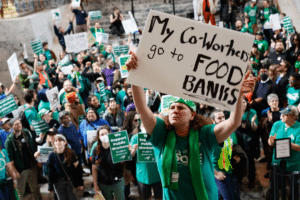

Workers’ compensation insurance gives employees access to a variety of benefits if they are injured on the job or develop an occupational illness. In Washington state, about 70% of workers’ comp claims are managed by the state’s department of Labor and Industries (L&I), while the remainder are handled by self-insured employers.

If your workers’ comp claim is accepted, benefits are available to help cover medical treatment costs, replace lost wages, pay for vocational retraining during the recovery period, and compensate you and your family for permanent disability or death resulting from the workplace accident.

Read below to learn about the five most common workers’ comp benefits in Washington!

Medical Benefits

L&I will pay for all of your medical bills, including doctor appointments, treatments, surgeries, occupational therapy and prescription medications, as long as they’re directly related to the workplace injury. These benefits are available until your doctor decides that your condition has reached maximum medical improvement (MMI) or when your claim is closed. But as long as your claim is open, even after you have returned to work, L&I medical benefits remain in place.

It’s important to note that L&I only reimburses medical providers who are part of its provider network (aside from the initial emergency room visits).

Learn more about L&I medical benefits.

Wage Replacement

Ensuring a steady paycheck is one of the first concerns of any employee sidelined by a work injury or illness. Wage replacement benefits, also known as “time loss compensation,” helps cover lost wages until the worker is healthy enough to return to work.

Keep in mind that L&I considers the first three days of missed work an unpaid “waiting period.” That means any wage replacement compensation you end up receiving will start to accrue on the fourth day following a work injury.

Time loss compensation covers between 60-75% of the workers’ wage at the time of injury (up to a maximum cap). Because it is considered a disability benefit by the IRS, wage replacement compensation is not considered taxable income by the IRS.

The percentage you receive depends on how many dependents you have, but you should always verify that L&I or your self-insured employer’s calculations are correct.

Wage replacement payments, which are typically disbursed twice per month by mail or electronic payment, require regular certification by your medical provider. Although workers who miss a certification will not receive their check for that period of time, they can seek back pay if they send proper certification at a later date.

A similar benefit, called “loss of earning power,” is available for injured workers who have returned to work at a reduced capacity while they are recovering. LEP compensation helps bridge the gap between what you were earning at the time of the injury and now.

Check out the Washington L&I LEP Calculator to estimate your benefit.

Disability Benefits

Severe workplace injuries may leave an employee permanently disabled. In these cases, you may be entitled to either a permanent partial disability settlement or a lifelong pension for a permanent total disability.

Permanent Partial Disability (PPD) awards are financial awards for injured employees who can return to work, but only in a limited capacity due a permanent disability from their injury such as an amputated finger.

The amount of a PPD award depends on the seriousness of the injury, based on your doctor’s assessment using calculations from L&I’s Permanent Partial Disability schedules.

Smaller PPD awards are typically paid in lump sums, while medium-to-large settlements are paid out in lump sums or time-based payments.

If your injury or condition prevents you from returning to work at all, you may be eligible for an L&I disability pension. Also known as Permanent Total Disability, this benefit is paid to a small number of workers every month for the rest of their lives.

Like the wage replacement benefit, pensions are between 60-75% of a worker’s wage at the time of the injury. But the twice-monthly pension payments continue for the duration of the injured worker’s life.

Because pensions are so lucrative, the process for securing one is complicated and lengthy. A claimant must work closely with a vocational expert and physicians to determine their eligibility. It is highly recommended to consult a lawyer if you are seeking a lifetime pension for your workplace injury.

Death Benefits

If a worker dies from a workplace injury or occupational disease, their spouse (or registered domestic partner) and dependents are entitled to L&I death benefits. These come in the form of one-time lump sum payments, survivor pensions and burial reimbursements.

Vocational Rehabilitation

Also known as vocational training, this benefit is designed to retrain a worker for a career that is better suited to the restrictions resulting from their injury or illness.

L&I refers the injured worker to a Vocational Rehabilitation Counselor (VRC) who will assess their abilities and suggest other jobs they can do. Typically, the injured worker is then offered retraining for a new line of work.

Keep in mind that this benefit is sometimes offered to an injured worker instead of other more desirable benefits like a pension. L&I has been known to assess a worker as able to work as a “cashier” even when the worker is clearly unable to perform that or any other job. If a VRC decides the worker is capable of being a cashier or any other type of job, other workers’ comp benefits are no longer available.

Learn more about vocational retraining.

Contact A Lawyer

Getting the benefits you deserve from a workers’ comp claim is a challenging endeavor. But don’t be discouraged. Call Emery | Reddy’s legal team to help you—with over 15 years of experience in workers compensation, injury law, and third-party claims, we’ll review your case to make sure you get the workers’ compensation benefits you’re entitled to and deserve.