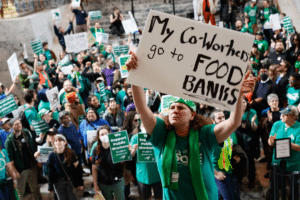

What do changes to workers compensation mean for injured workers?

As they explain, corporate lawyers like Bill Minick in Dallas have literally been plotting a revolution in how employers take care of workers injured on the job. Minick’sidea is simply to let those companies opt out of state workers’ compensation laws — and draft their own rules. His clients include corporate giants like Walmart, McDonald’s, Nordstroms, Lowes and dozens of other businesses that are an everyday, household name.

These changes have already begun to transform the landscape of workers compensation. A significant number of the biggest retail, trucking, health care and food companies have already chosen to “opt out” in Texas; Oklahoma has also moved in the same direction, and Tennessee and South Carolina are considering similar measures.

But there has been little attention paid to what these changes mean for American workers. ProPublica and NPR looked into the changes by reviewing the injury benefit plans of move than 120 companies that opted out in Oklahoma and Texas to see how those plans compare to state workers’ compensation.

Their investigation shows that these plans have lower benefits almost entirely across the board, more restrictions and practically no independent oversight.

As the report states:

“Already in Texas, plans written by Minick’s firm allow for a hodgepodge of provisions that are far different from workers’ comp. They’re why McDonald’s doesn’t cover carpal tunnel syndrome and why Brookdale Senior Living, the nation’s largest chain of assisted living facilities, doesn’t cover most bacterial infections. Why Taco Bell can accompany injured workers to doctors’ appointments and Sears can deny benefits if workers don’t report injuries by the end of their shifts.

And it’s Minick’s handiwork that allows Costco to pay only $15,000 to workers who lose a finger while its rival Walmart pays $25,000.”

The implications are truly frightening. Traditional workers’ compensation guarantees lifetime medical care while the new corporate plans terminate treatment after just two years. They also don’t pay compensation for many – actually most – permanent disabilities, and put very tight limits on payouts for family deaths and other “catastrophic” workplace injuries like amputation, paralysis or blindness.

In fact, as the report states quite explicitly, “The list of what the plans don’t cover runs for pages”:

“They typically won’t pay for wheelchair vans, exposure to asbestos, silica dust or mold, assaults unless the employee is defending “an employer’s business or property,” chiropractors or any more than 75 home health care visits. Costco won’t cover external hearing aids costing more than $600. The cheapest external hearing aid Costco sells? $900.”

One can quickly see what this would mean for the workers compensation system write large if the trend continues to expand across the U.S. The new private plans becoming popular in Texas and Oklahoma give employers almost total control over the medical and legal process when their workers get injured. Employers get to choose the doctors they see and can have those workers examined over and over again – as often as they want, in fact. Moreover, the companies can settle claims at any time. Workers are forced to accept whatever is offered – or automatically lose all benefits. If they want to appeal, they may — but they have to do this before a committee set up by their employers.

This is a truly un-American and unethical trend. The U.S. workers’ compensation system was founded on the ideal that employers owed a duty to injured workers (and their families) who had served them. Laws in every state mandates that they cover workers’ medical bills and a portion of their lost wages until the worker recovers — or for life if they don’t recover.

Critics say that these changes are a return to the Industrial Age before workers’ compensation, when workers or surviving family member had to sue their employers or cover the costs of on-the-job injuries themselves.

“That’s the system we had in place 100 years ago,” said Trey Gillespie, senior workers’ comp director for the Property Casualty Insurers Association of America. “This is not an innovative concept.”

Workers agree. Mike Pinckard, a Fort Worth truck driver for 31 years, has had two hernias previously in his career. Both times they were covered by Workers Compensation. So he assumed that would be the case last month when we experienced a third hernia while pulling a heavy cart on the job. But under his employer’s new “opt out” program, the 58 year old worker learned that the injury wasn’t covered any more, and he’s now spent over $10,000 in deductibles and copays to get the hernia covered by his health plan.

“I gave my body and soul to the company, and they were doing the same back until last year,” he said. “It’s just an easy way for the company to get out of when you get hurt. It’s all it is.”

Read the full report from NPR and Pro-Publica here: Inside Corporate America’s Campaign to Ditch Workers’ Comp (October 14, 2015)